Buy a Home… And the Seller’s Low-Rate Mortgage

Most buyers don’t realize some homes let you take over the seller’s existing loan.

In today’s high-rate market, that could mean stepping into a 2–4% mortgage instead of today’s rates — and saving serious money every month.

FAQ's

New to this idea? You’re not alone.

What exactly is an “assumable” mortgage?

An assumable mortgage lets a buyer potentially take over the seller’s existing loan — rate and all — instead of getting a brand-new mortgage at today’s rates.

Example: Seller has a 2.75% rate → you may be able to take it over, if approved.

"FHA, VA and USDA loans are all assumable by law."

Why would I want to buy a home with the seller’s mortgage?

Because a seller’s low-rate loan can be a huge advantage for you. In today’s market, taking over a 2–4% mortgage may save you tens of thousands in interest over time — sometimes more than negotiating the purchase price.

That’s why buyers pay close attention to homes with low-rate, transferable loans. You’re not just buying the house — you'd be locking in a much better interest rate. This is commonly known as a loan assumption.

Win for you. Win for the seller.

What happens to the loan and the seller’s equity?

If approved by the lender, you take over the seller’s existing mortgage — including the interest rate, remaining balance, and time left on the loan.

For example: If the seller has 12 years left on their loan, you step in at year 12 — you don’t restart a new 30-year mortgage.

At closing, you bring cash to cover the seller’s equity, which is the difference between the purchase price and what’s still owed on the mortgage.

Because there’s no new loan being created, there’s no traditional down payment required. Your cash goes toward the seller’s equity instead — often allowing you to lock in a much lower rate than what’s available today.

Why haven't I heard of this before?

Lenders don’t advertise it—because there’s no big payday for them unless they write a new loan.

Most homeowners and Buyers don’t know this: FHA, VA, and other government-backed loans are transferable to a new Buyer, by law.

What if the seller’s rate isn’t super low?

You might still benefit. Many existing mortgages from the past few years are lower than today’s rates, so even a “moderate” rate can make a meaningful difference in your monthly payment and long-term interest.

The only way to know is to check — no obligation, just clarity.

Do buyers need a down payment or extra fees?

Not like with a traditional mortgage. Because you’re taking over an existing loan, there’s no new lender loan being created. That means you typically skip many of the big upfront costs — no traditional down payment to a lender, no appraisal fee, and no new loan origination fees.

Instead of paying those thousands to a lender, your cash goes toward the seller’s equity — the difference between the home’s price and what’s still owed on the loan.

Quick example:

If the seller still owes $300,000 on their mortgage and the purchase price includes $80,000 in equity, you bring $80,000 to closing. That money goes directly to the seller — not a lender — and you step into the existing loan.

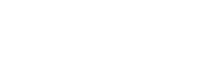

Monthly payment comparison (principal & interest):

Assumed loan (2.75%) → ~$1,225/month

New loan at today’s rates (6.5–7%) → ~$1,900–$2,000/month

That’s roughly $700 less per month — which is why these opportunities can make a real impact for buyers.

Is the timeline different than a normal purchase?

Because this isn’t a brand-new loan, the timeline can be a bit longer.

Traditional financing often closes in about 30 days, while taking over an existing loan typically takes 45–60 days, depending on the lender.

“What buyers told us”

In this case, multiple buyers shared that the 2.75% rate was the main reason they pursued the home. Even with competition, the long-term savings made the numbers work for them.

"I’m Pablo Salazar, Broker Associate with 20 years of grit, grind and real‑estate wins. I’m proud to have played a role in helping my clients achieve their real‑estate goals, and I look forward to continuing to deliver outstanding results for each and every one of you in the future."

Find out if you can take over a seller’s loan — and lock in a lower monthly payment.

Pablo salazar

Broker Associate - 38 Degrees Real Estate - DRE Lic 01722824

A Low-Rate Mortgage Could Be Your Biggest Buying Advantage.

See if homes you’re looking at allow a loan transfer.

• Terms and conditions apply • Not intended as a solicitation if you're already partnered with another broker • Privacy Policy